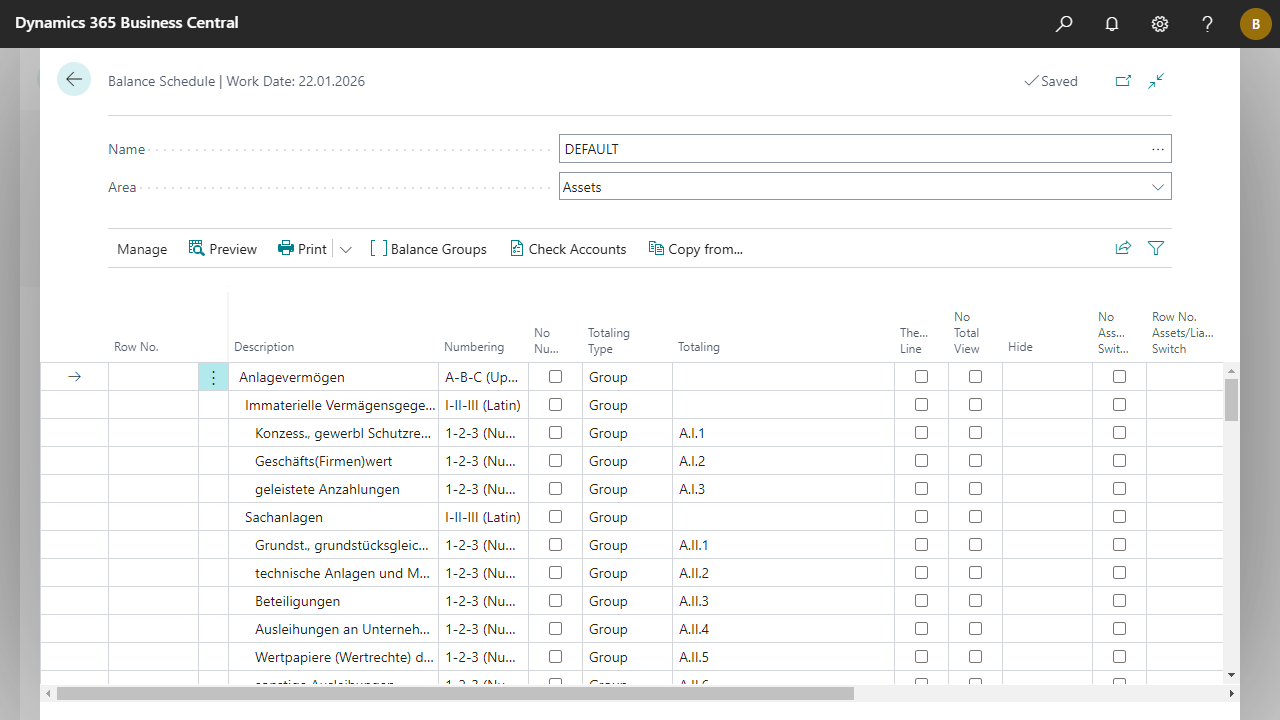

Edit Balance Schedule

Edit Balance Schedule

| Row No. | Specifies a row number which can be used in other lines in a Formula (field Totaling Type).

You can also assign a row number more than once. This allows you, for example, to add together several balance groups located in different positions in one formula.

|

| Description | Specifies a description for the line. |

| Numbering | Specifies the numbering type. For example, the first time you select A-B-C (Upper), that line is marked with A, the next one with B, and so on. The other options work in exactly the same way. |

| No Numbering | Specifies that no numbering should be done for this line. |

| Totaling Type | Determines which type of calculation should be performed for the line.

Options:

|

| Totaling | Depending on the Totaling Type field, select the valid values here.

|

| Thereof Line | Specifies whether this is a Thereof Line whose value is not automatically included in the total lines. The display is automatically indented by a further level. Lines with Totaling Type Group and Account can be defined as a Thereof Line. |

| No Total View | Specifies whether the automatic display as a total line (right-justified with separator lines) should be suppressed. This selection affects the Formula, End-Total, Begin-End-Total, and Group-Total Totaling Types. |

| Hide | Specifies which information of this line should be hidden.

Options:

|

| No Assets/Liabilities Switch | Indicates whether no asset/liability switch should be made. By default, an account defined in Assets is displayed only if it has a positive balance. In the liabilities, only those with a negative balance are displayed. If you activate this field, the line will be displayed where it is defined, regardless of the balance. (e.g. negative balances of depreciation accounts if you use indirect depreciation for assets). Note that the negative or positive balance definition always refers to the actual balance in Financial Accounting. The Show Opposite Sign field has no effect on this function. The setting in this field affects the Group, Account and Group-Total Totaling Types. |

| Row No. Assets/Liabilities Switch | Specifies whether the asset/liability switch should be made based on another line. In this case, specify the Row No. of the line that should control the switch of the current line. Only lines located before the current line can be accessed. |

| Show Opposite Sign | Specifies whether the sign of the result in this line should be reversed. The setting is ignored for Totaling Type Formula. |

| Income Base | Specifies whether the selected line should be used as the basis for the income statement. This field is used as a reference point (100% basis) in the income statement. All other lines are calculated in relation to this as a percentage. For example, you can specify the line Operating performance as the basis. A multiple selection is possible - the sum of the lines for which the income base is set forms the calculation basis. |

| Income Balance at Date | Indicates whether the Balance at Date and not the Net Change should be used in the selected line. Thus, not only profit and loss accounts but also balance sheet accounts can be evaluated in the income statement. |

| Orientation | Specifies the orientation for the line. |

| New Page | Specifies whether a page break should occur before the current line. |

| Bold | Specifies whether to print the line in bold or not. With Automatic, only automatically generated total lines are printed in bold. The setting does not affect the Detailed G/L Account Lines. |

| Italic | Specifies whether to print the line in italics. |

| Underline | Specifies whether to underline the line when printing. |

| E-Document - ebInterface Create and send e-invoices in accordance with the Austrian standard. More information  |