Cash Registers

Cash Registers

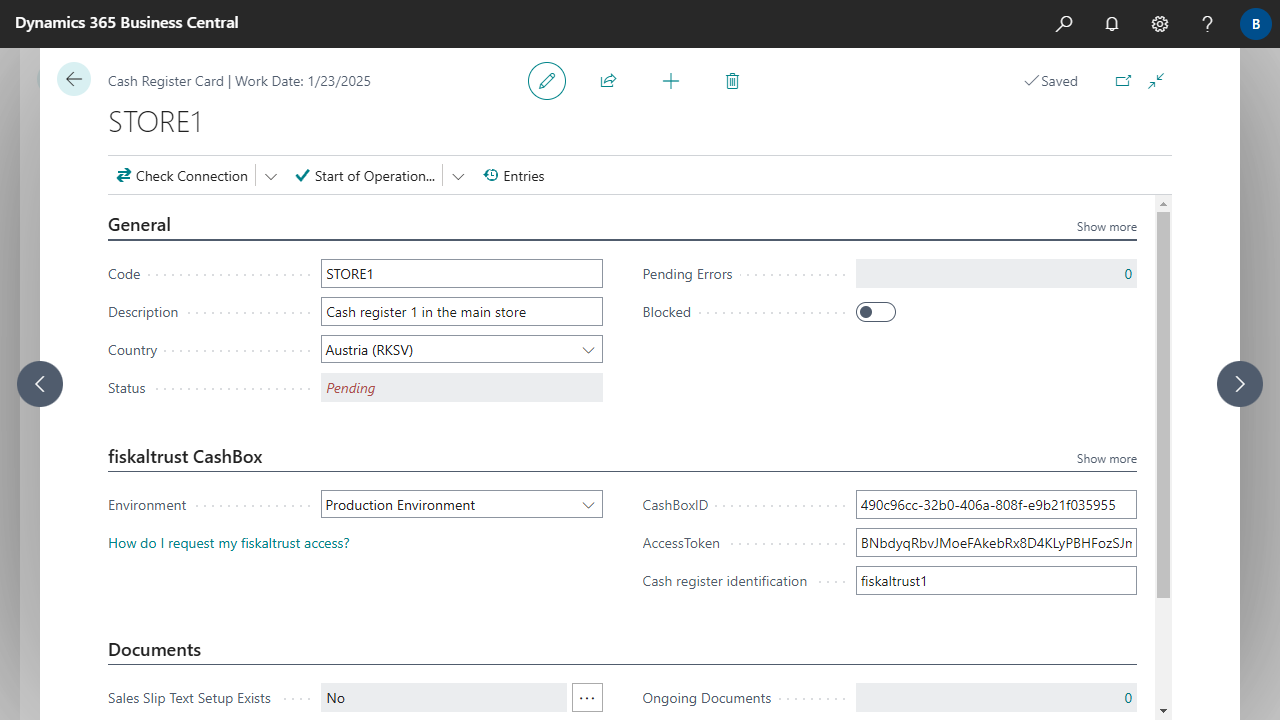

| Code | Specifies a Code for the Cash Register. For historical reasons, this field is case-sensitive, as the Code used to have to match the ID stored in the fiscal trust service. This was later changed and the ID stored in the fiskaltrust service has since been stored in the Cash register identification field.

|

| Description | Specifies a description for the Cash Register. |

| Country | Specifies the Country for the Cash Register. |

| Status | Specifies the current state of the Cash Register.

|

| Pending Errors | Specifies the number of Cash Register Entries with a pending error for the Cash Register. For more information, see Working with the App, Error Handling. |

| Allow Manual Completion | Specifies whether the Complete manually action may be executed in the Cash Register Entries.

|

| Blocked | Specifies whether the Cash Register is blocked.

You cannot post documents with a blocked Cash Register.

|

| Environment | Specifies whether the Cash Register should send data to the fiskaltrust production environment or to the fiskaltrust test environment. |

| CashBoxID | Specifies the CashBoxID of the fiscaltrust CashBox. You can find the information in the fiskaltrust portal in the CashBox section.

For more information, see General, fiskaltrust Access Data.

|

| AccessToken | Specifies the AccessToken of the fiscaltrust CashBox. You can find the information in the fiskaltrust portal in the CashBox section.

For more information, see General, fiskaltrust Access Data.

|

| Cash register identification | Specifies the Cash register identification of the fiscaltrust CashBox. You can find the information in the fiskaltrust portal in the CashBox section. For more information, see General, fiskaltrust Access Data. |

| Timeout (Milliseconds) | Specifies the length of time in milliseconds that the service is allowed to use, before aborting with an error. If you don't set a duration, then a default value is used. The default value is currently 100000 ms (100 seconds). |

| Sales Slip Text Setup Exists | Specifies whether beginning- and/or ending-texts for the sales slip are set for the Cash Register. Click on the field to set up the texts. For each text, a time period can be specified in which the text is valid. The text can contain up to 1000 characters. Line breaks in the text are also possible. All texts valid at the time of posting are stored for the posted document. |

| Ongoing Documents | Specifies the number of ongoing sales documents for the Cash Register. Ongoing documents were created but not yet posted. |

| Ongoing Service Documents | Specifies the number of ongoing service documents for the Cash Register. Ongoing service documents were created but not yet posted. |

| Last Month Document Date | Specifies the date of the last month document for the Cash Register. |

| Last Year Document Date | Specifies the date of the last year document for the Cash Register. |

| Start of Operation Date | Specifies the start of operation date for the Cash Register. |

| End of Operation Date | Specifies the end of operation date for the Cash Register. |

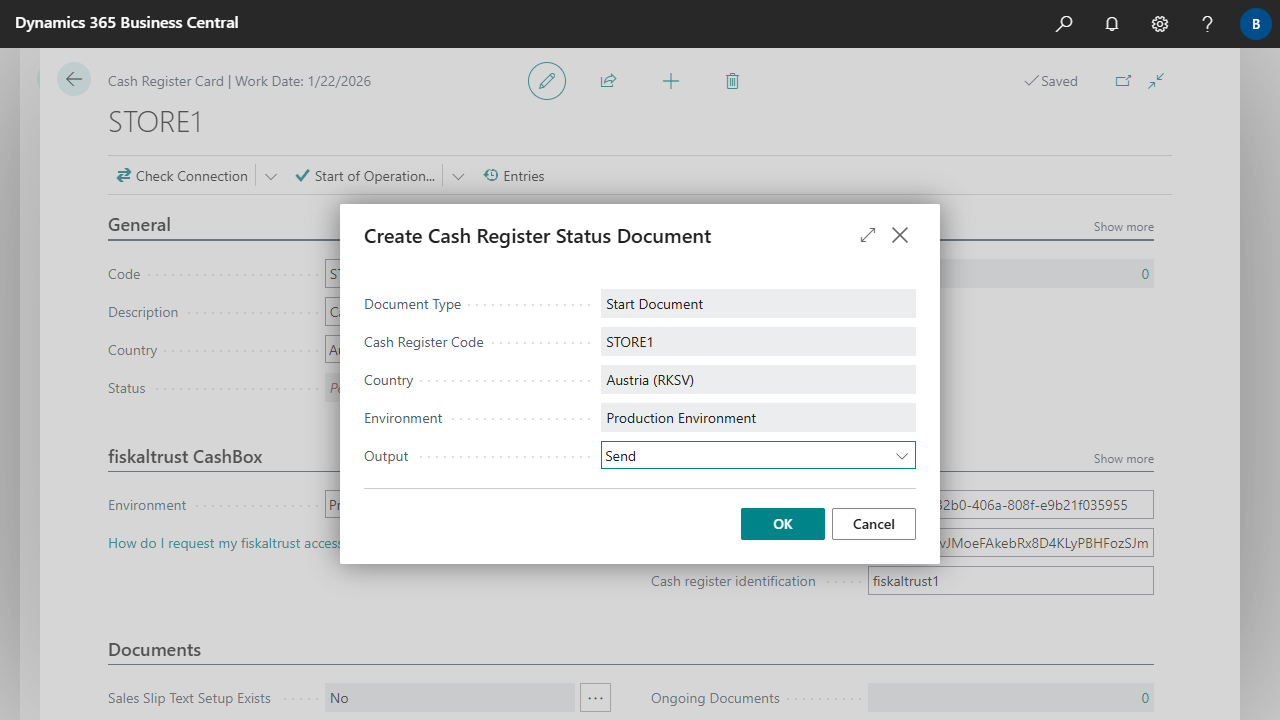

The start document will be created as a Posted Sales Invoice with Amount 0.

If the document has been successfully signed by the service, the Status of the cash register is set to Active.

If an error occurs, the cause of the error must first be corrected and then a further signature attempt must be made with the Fix Errors action.

For more information, see Working with the App, Error Handling.

The start document will be created as a Posted Sales Invoice with Amount 0.

If the document has been successfully signed by the service, the Status of the cash register is set to Active.

If an error occurs, the cause of the error must first be corrected and then a further signature attempt must be made with the Fix Errors action.

For more information, see Working with the App, Error Handling.

| E-Document - ebInterface Create and send e-invoices in accordance with the Austrian standard. More information  |