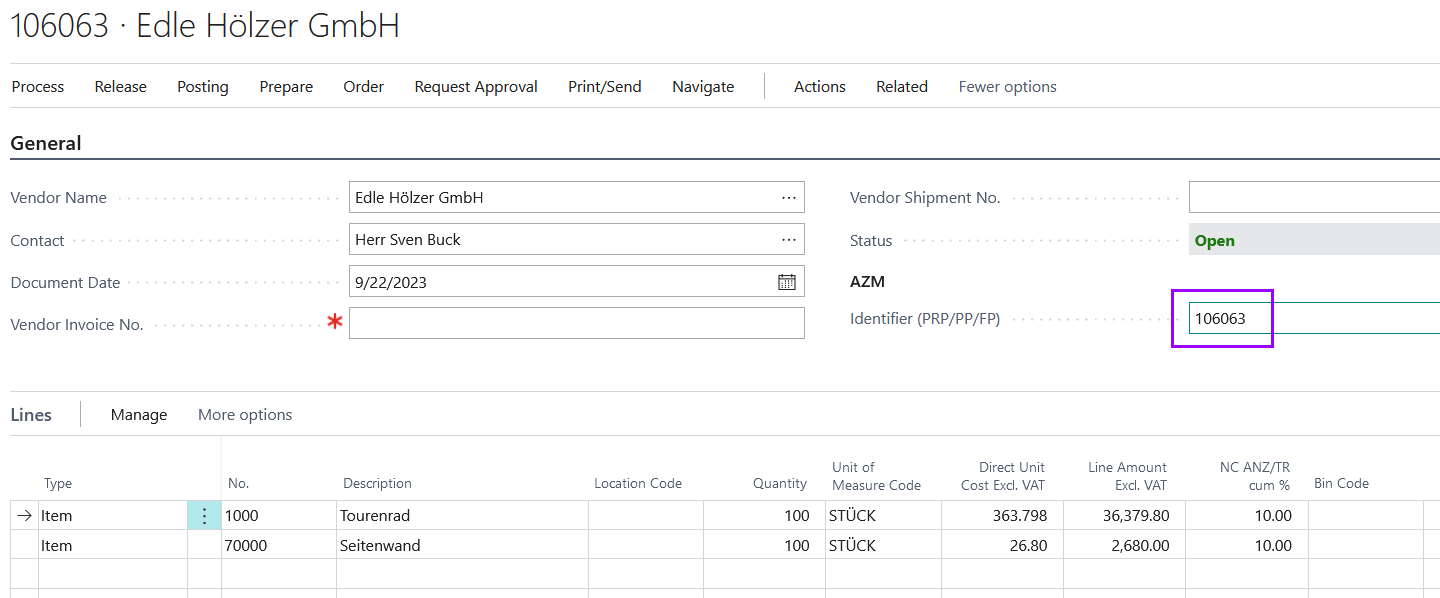

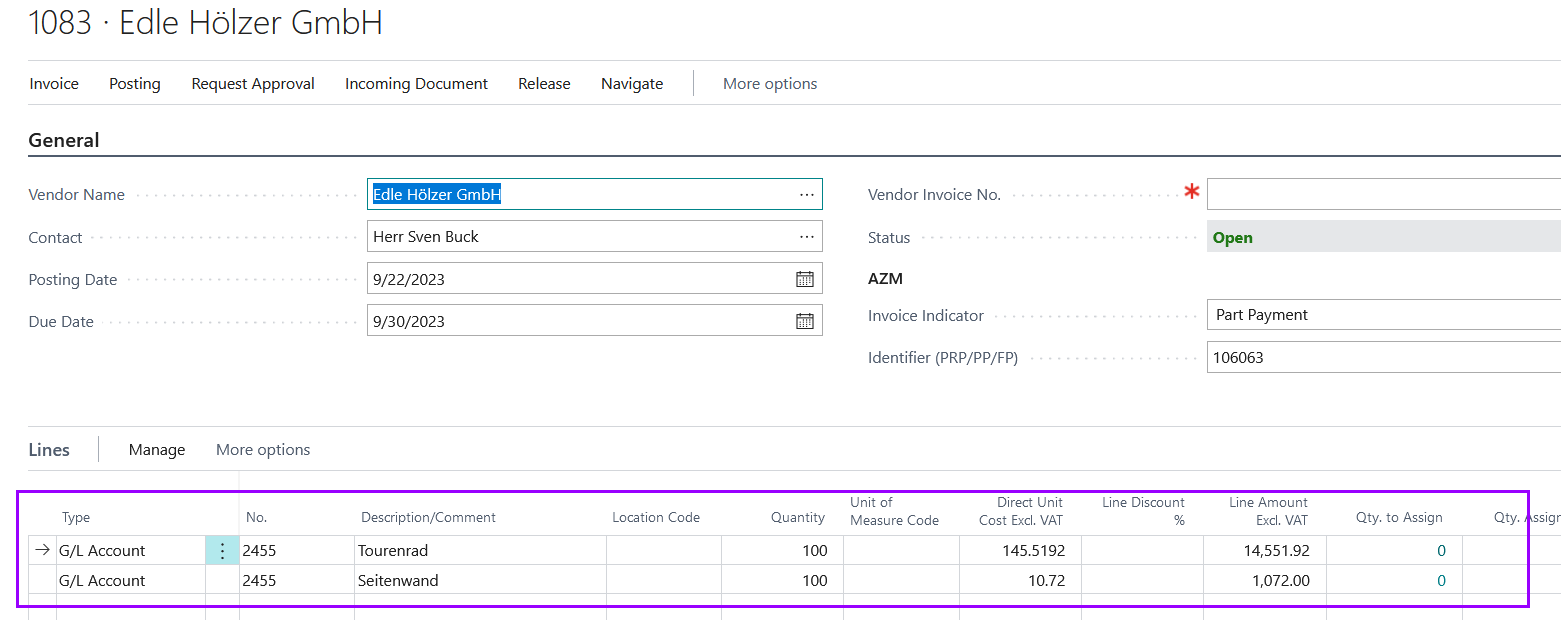

In purchasing, the prerequisite for the use of the pre-payment and partial invoices is a purchase order. In the purchasing header in the General tab, there is a field Identifier (PRP/PP/FP). Behind this identifier there is a table in which you can store and create a new data record for the order and thus create a pre-payment plan. If a value is entered in this field and then assigned, pre-payments and partial invoices can be created for this order. The system can only use an identifier for one order. Each new order requires the creation of a new identifier.

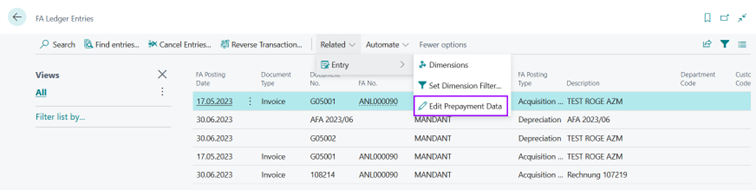

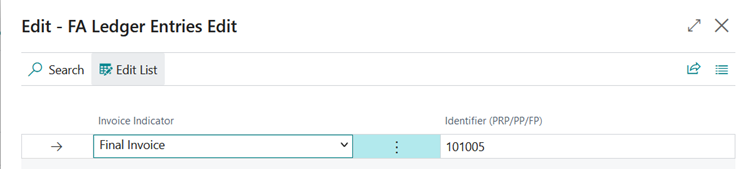

Beside Documents (Header and Lines) Prepayment Module - fields (“Invoice Indicator” and “Identifier (PRP/PP/FP)”) are also transferred to following entries:

You can add Prepayment Module - fields (“Invoice Indicator” and “Identifier (PRP/PP/FP)”) to Finance journals. Filled Prepayment Module - fields are transferred to above mentioned entries.

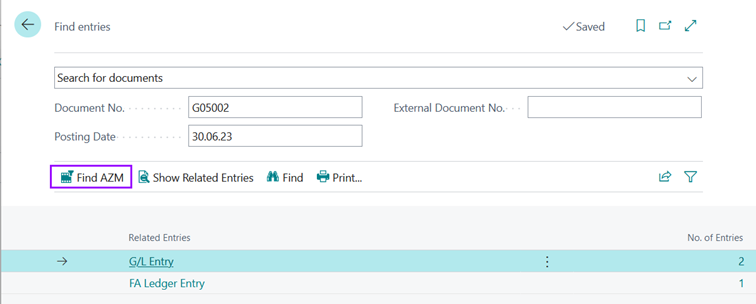

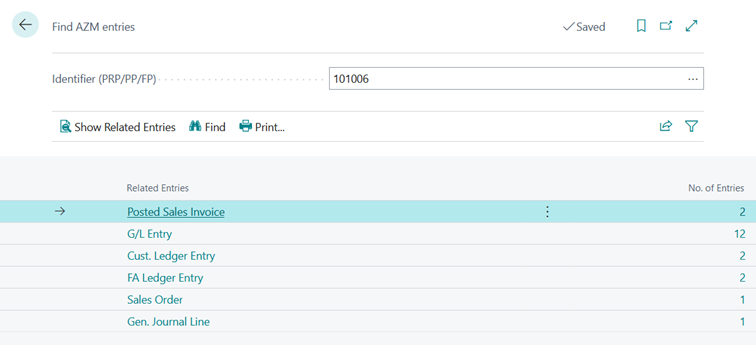

In order to see all entries with same “Identifier (PRP/PP/FP)” with one view, you can use function “Find AZM entries” in page “Find entries”..

If you use this function, you will see under specification of “Identifier (PRP/PP/FP)” and use of function “Find” all entries and documents with same “Identifier (PRP/PP/FP)”.

If you use this function, you will see under specification of “Identifier (PRP/PP/FP)” and use of function “Find” all entries and documents with same “Identifier (PRP/PP/FP)”.

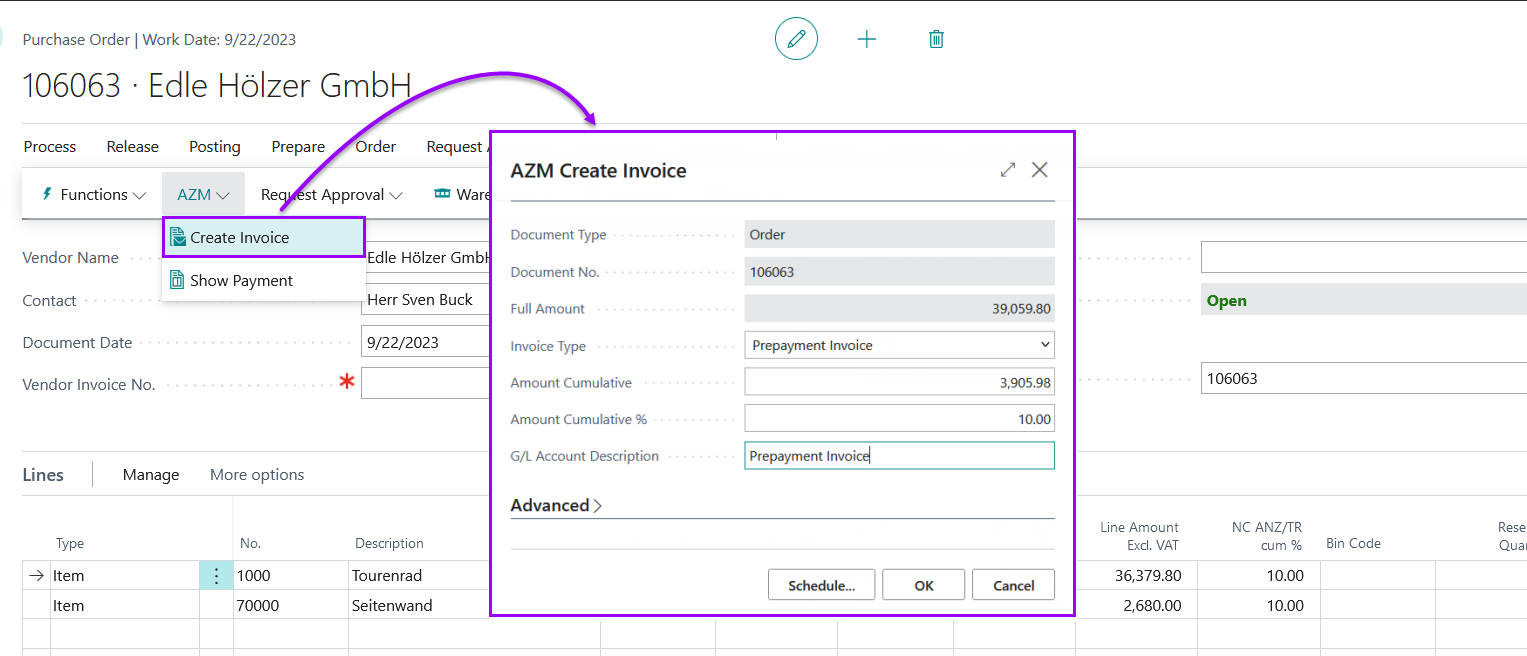

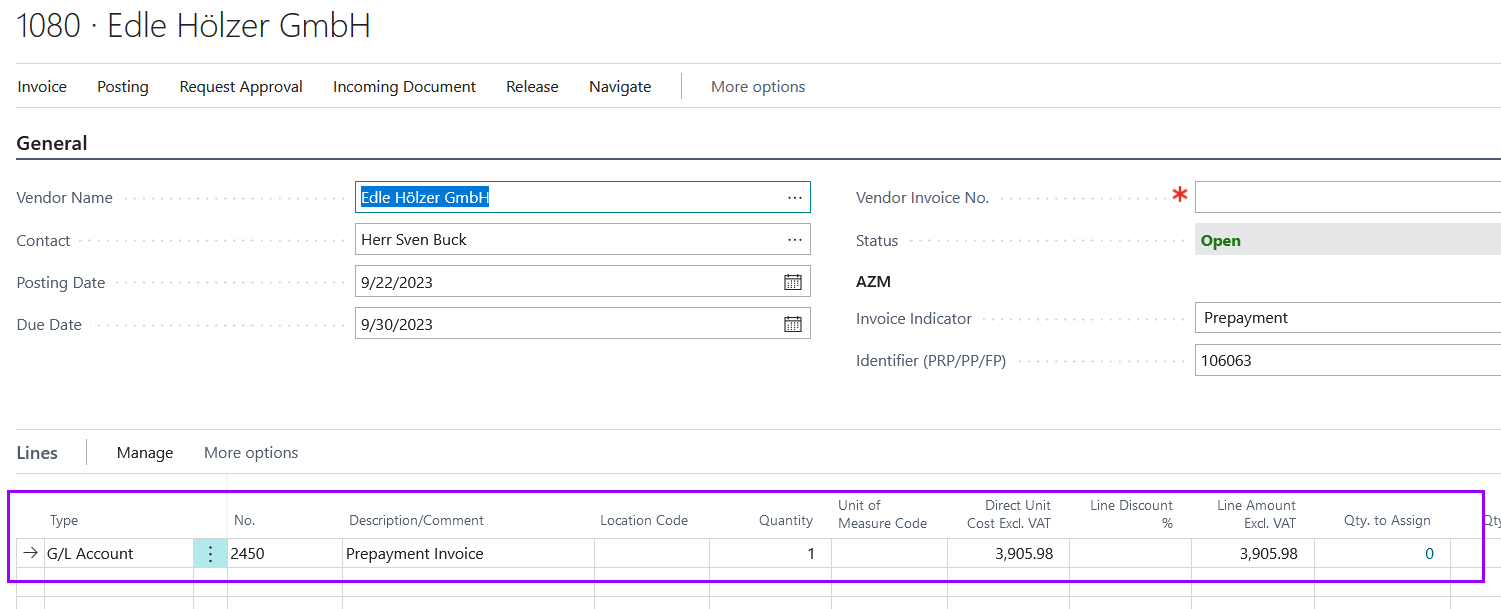

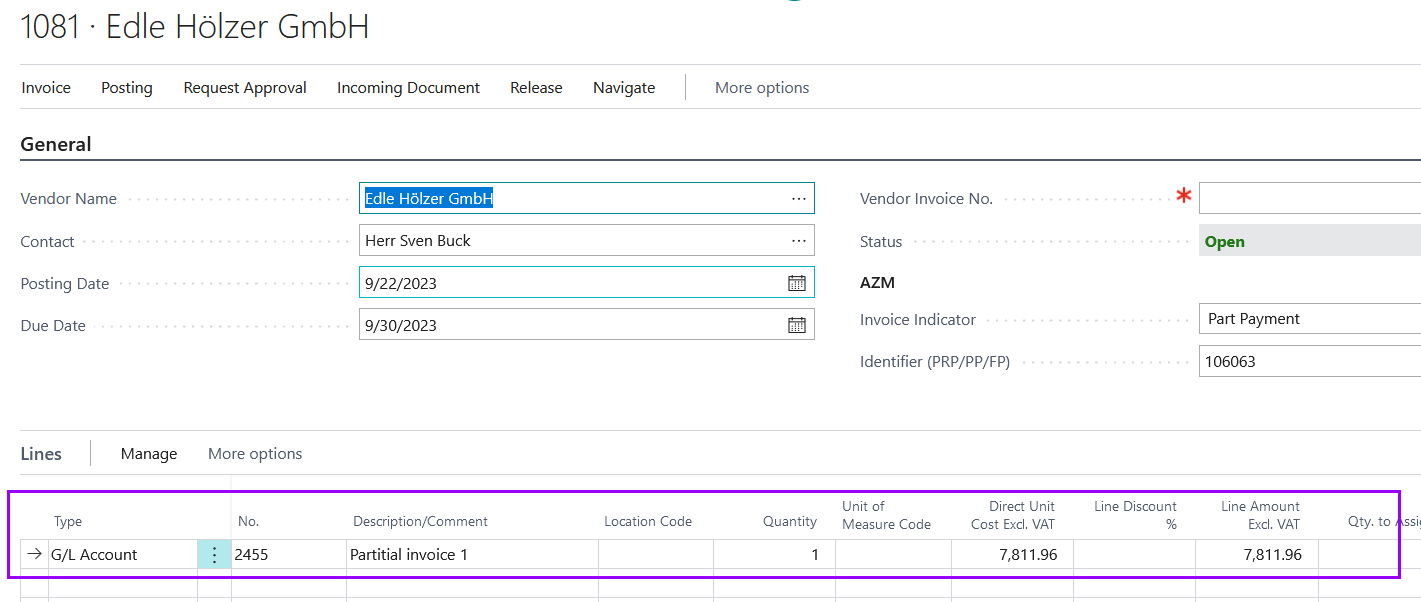

For pre-payment invoices, a cumulated invoice can be created in the purchase order. In this case, only one invoice line can be entered with the cumulated sum, in the pre-payment invoice. „Create invoice" opens a dialogue window where "Prepayment Invoice" can be chosen in the field Invoice type. Then a percentage or an amount can be entered in the window as desired. This amount then corresponds to the net amount of the created pre-payment invoice. In the field G/L account description, the row description for the cumulated sum is entered.

The created cumulated sum invoice contains a row with the description and the amount from the "AZM Create Invoice" window. The combination of gen. business posting group and gen. product posting group is pulled from the gen. business posting group field via the vendor (gen. business posting group) and from the general ledger setup (pre-payments/partial invoices tab). The G/L account to which the pre-payment invoice is posted is pulled from the general posting setup from the "purchase pre-payment invoice" account field.

After approval, the invoice can be posted.

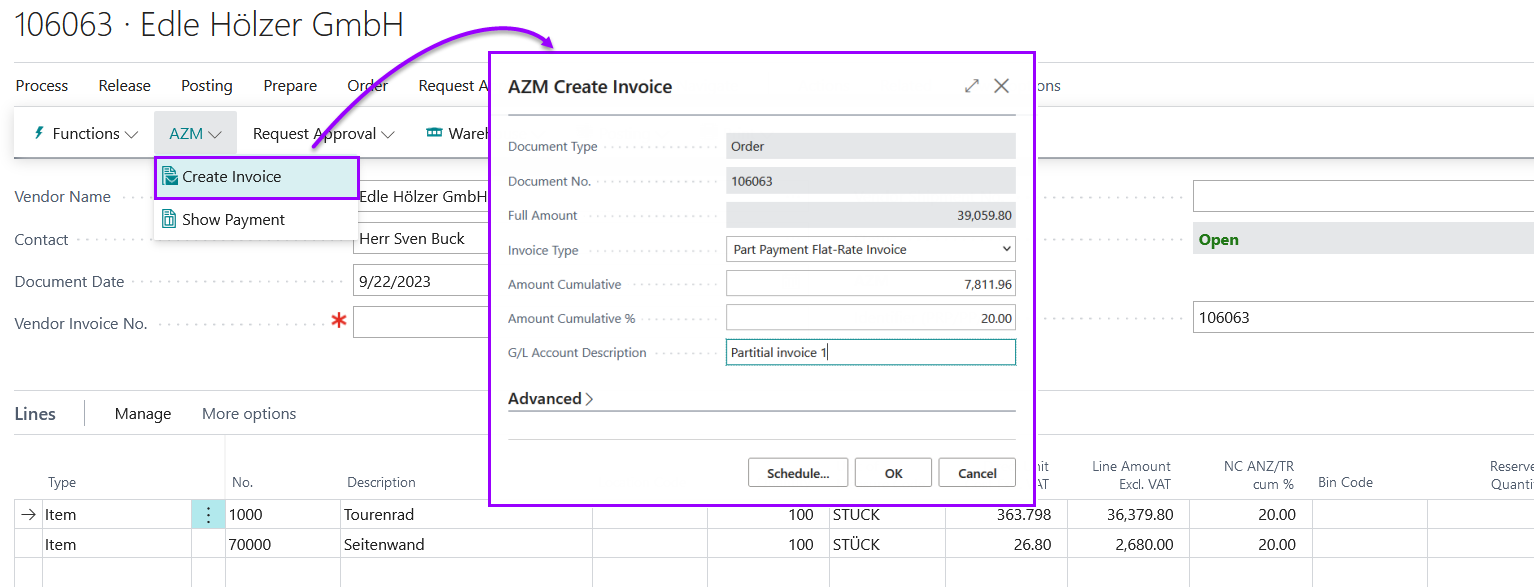

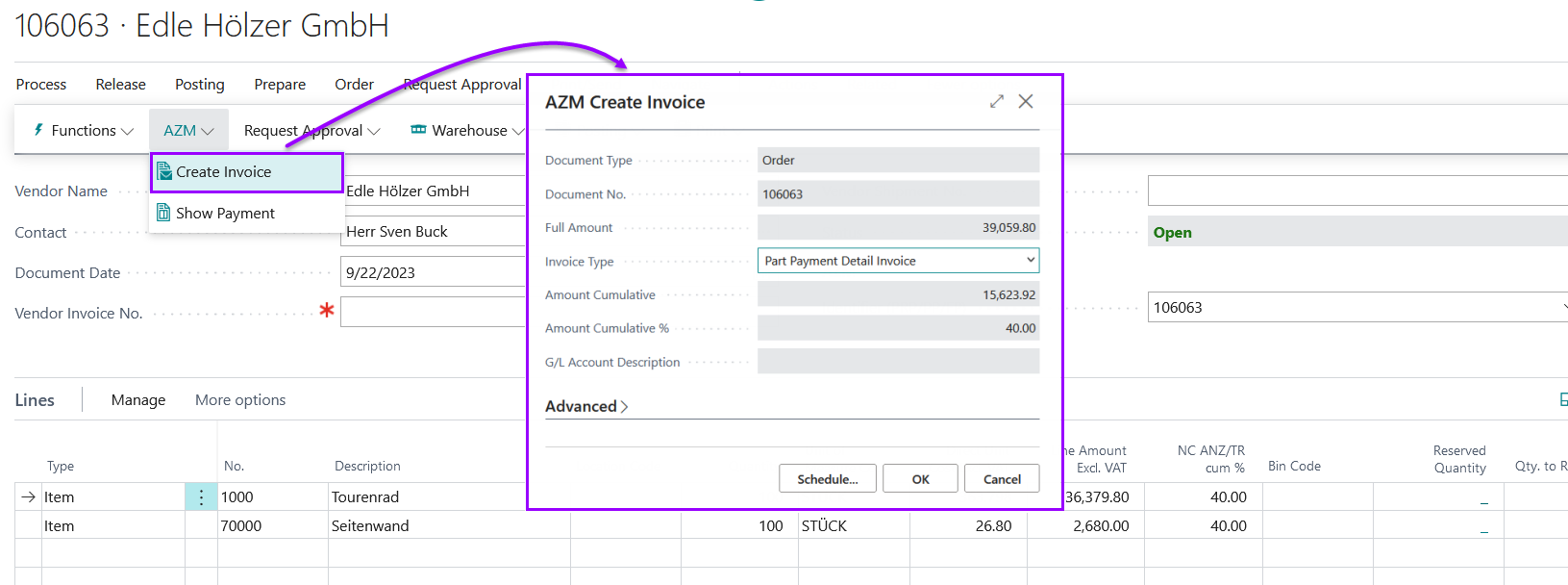

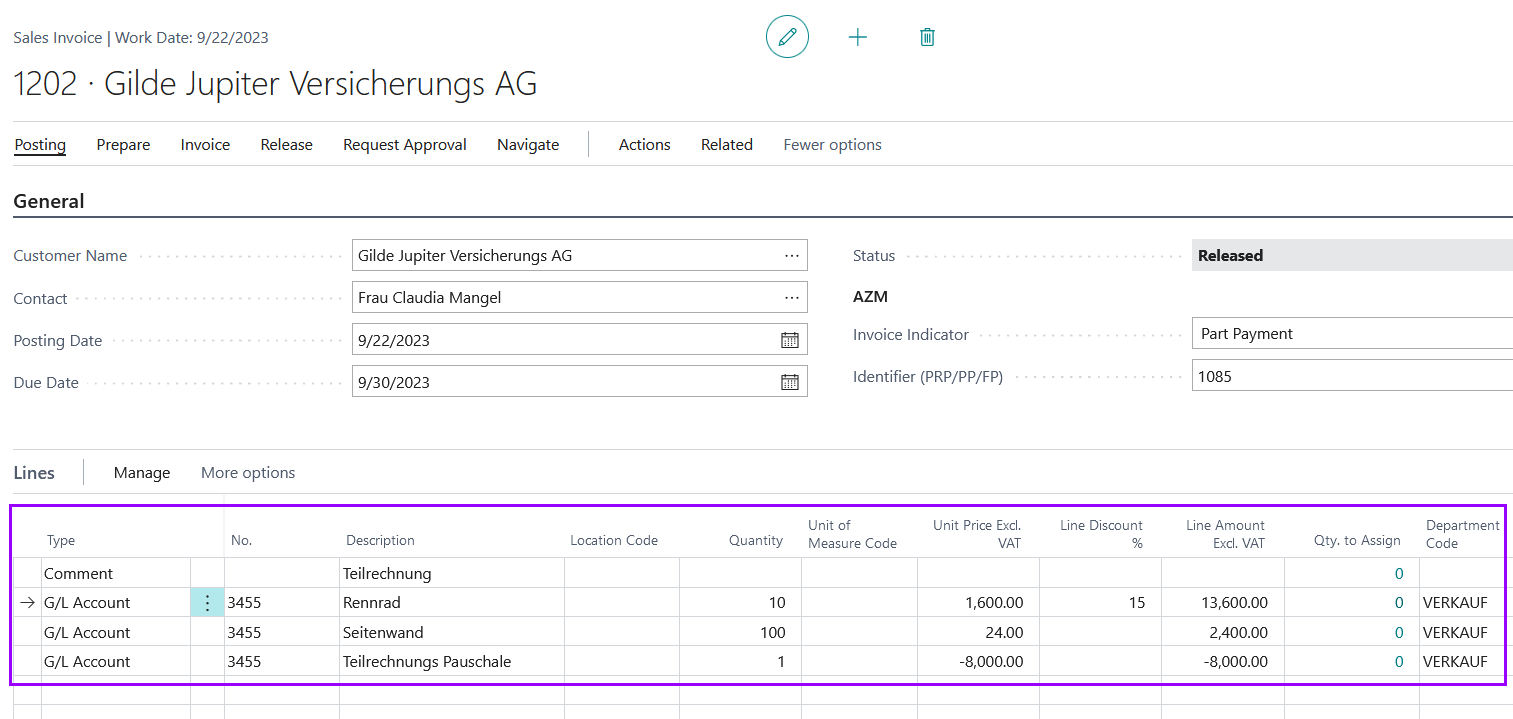

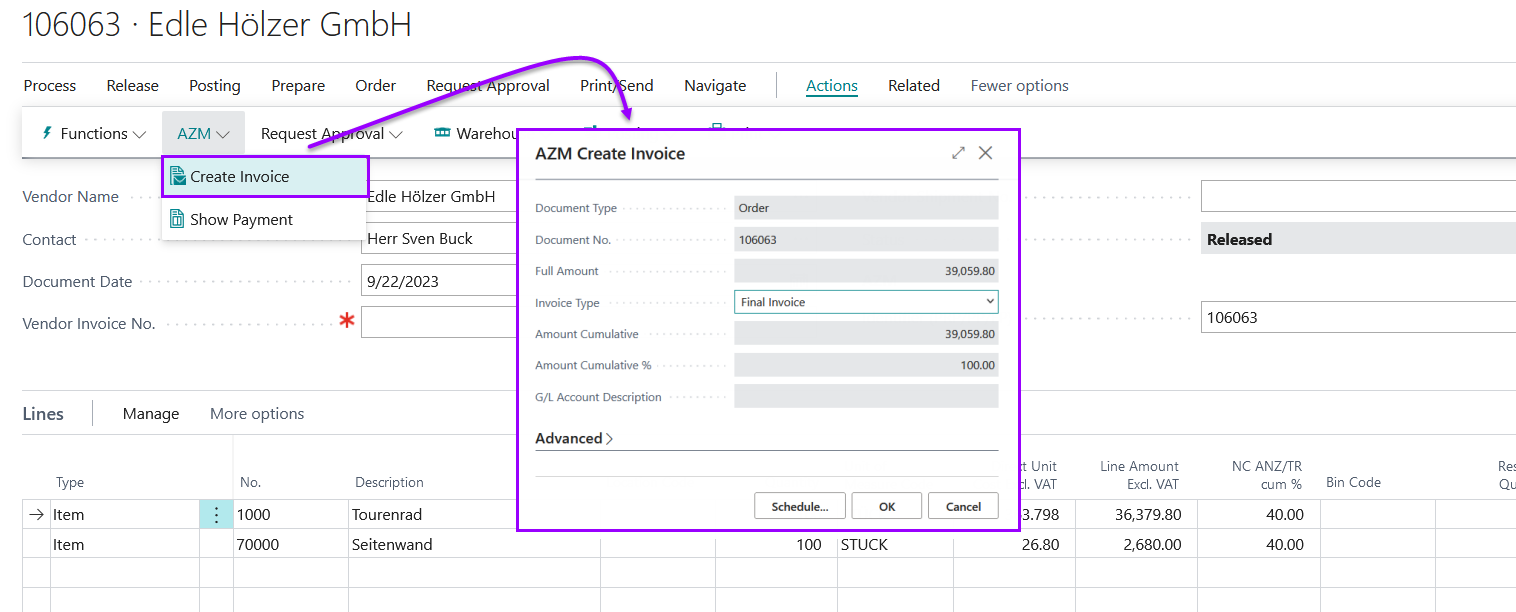

A flat-rate invoice is created from the order via the menu: Actions -> AZM -> "Create invoice". In the field Invoice type, select "Part Payment Flat-Rate Invoice".

After release, a credit note is created in the background to balance the pre-payment invoice. (see "Cumulation")

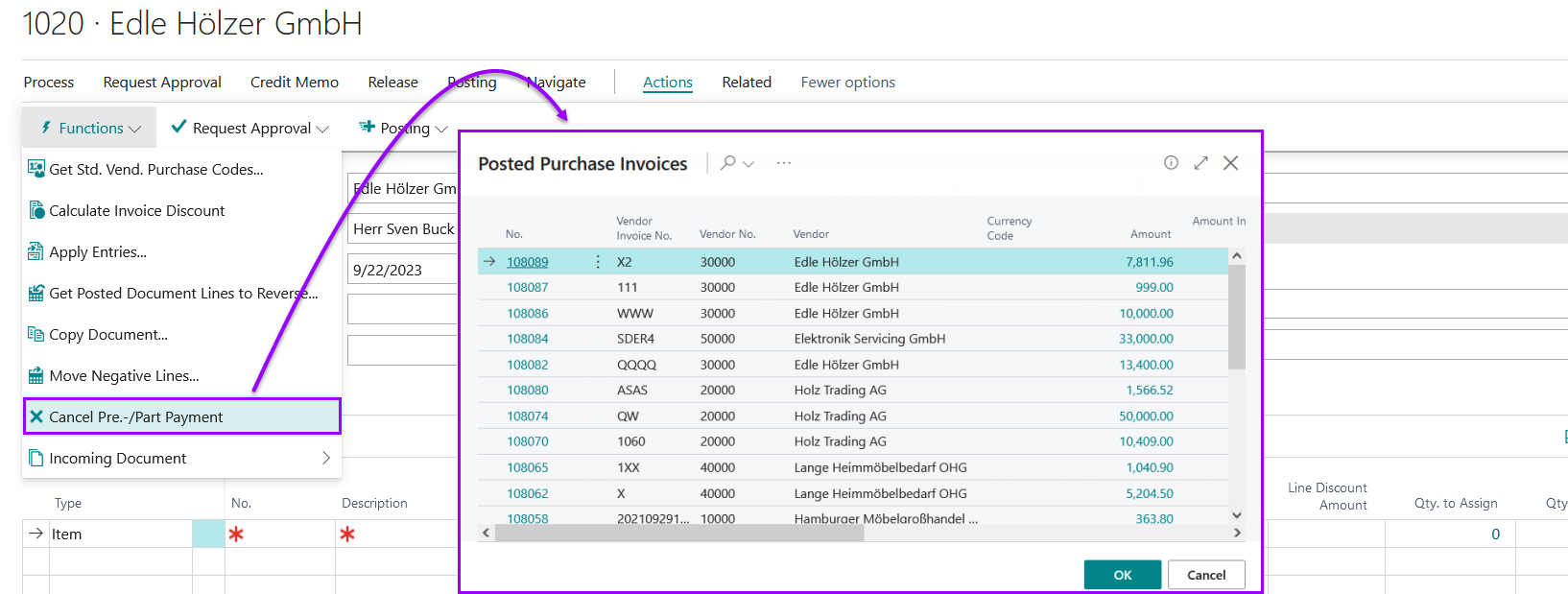

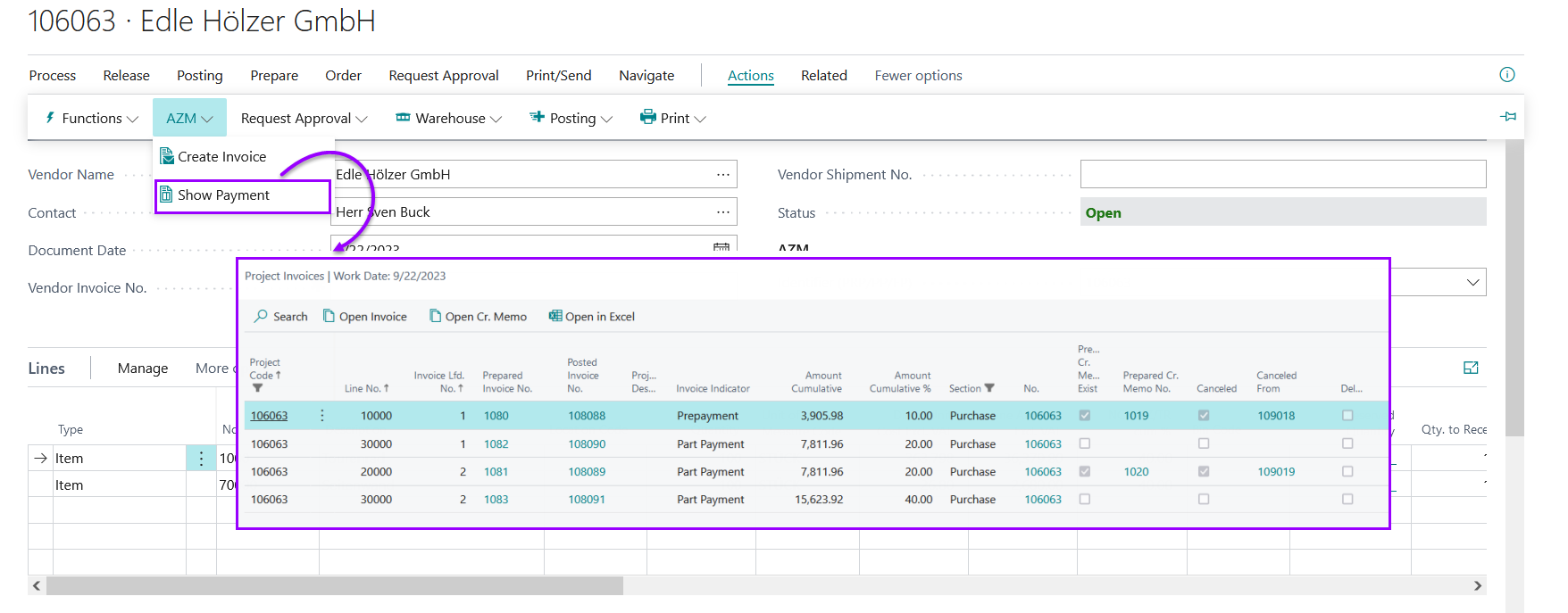

The last generated partial invoice can always be cancelled via the cancellation function, so it can still be corrected. Hence a new purchase credit note is to be created with the respective Vendor. Then the window is called up via the menu call Actions - Cancel Invoice/Partial Invoice Function in which the partial or pre-payment invoice to be cancelled can be selected.

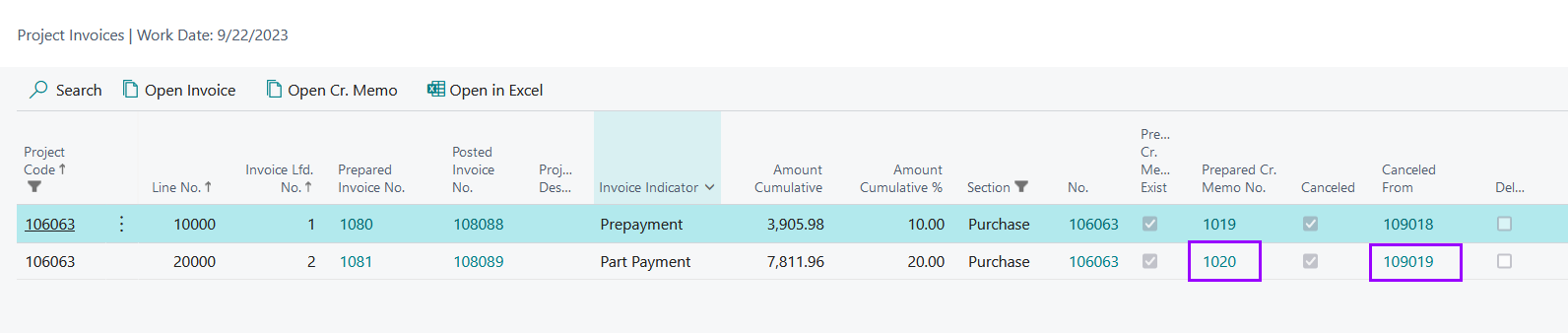

After selection, the credit note is automatically created and linked to the partial or pre-payment invoice that will be cancelled. The link is visible in the payment plan of the purchase order in the Prepared credit note field. From there, the credit note can also be called up at any time. The credit note can then be posted, and the last pre-payment or partial invoice is cancelled. The posted credit note is then linked in the payment plan and the cancellation is marked. The no. of the partial or pre-payment invoice is then free again.

A new "partial invoice flat rate" can be created thereafter, and any corrections will be made.

A partial invoice always refers to each line from the purchase order.

After the lines in the order have been prepared accordingly, the Actions - AZM - Create Invoice opens the window "AZM Create Invoice". In the field Invoice type, select "Partial invoice document".

In this case, a value must be entered in the field "NC ANZ/TR cum. %" in each line of the order before calling up - "Create invoice". The value in this field must be entered cumulatively. Example: In the first invoice 10 % of the order total should be, in the second another 10 %, i.e. cumulatively 20 %, and so on.

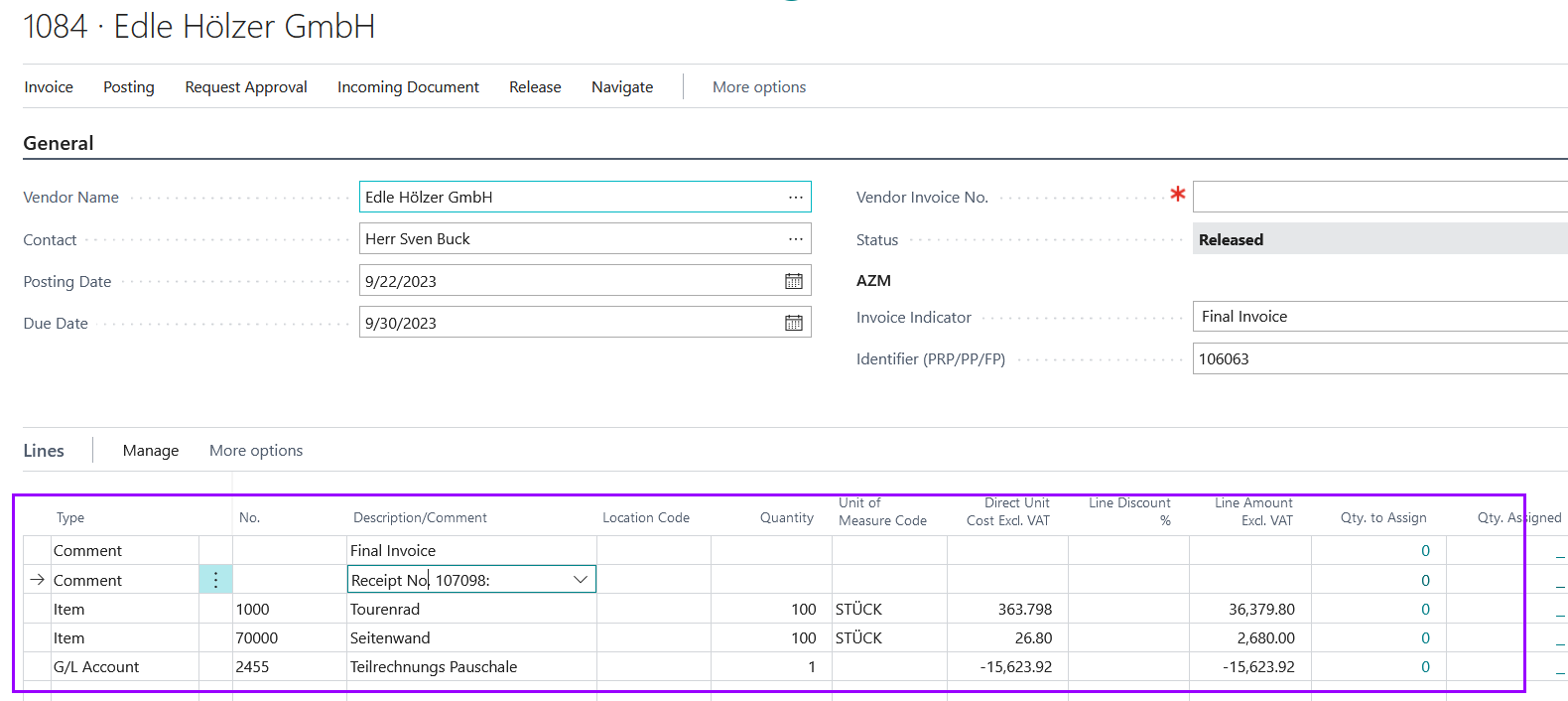

In the detail document, a line is also created in the partial invoice for each line from the purchase order.

When the invoice is released, the previously booked pre-payment/partial invoice is deducted.

Before this, the following requirements must be met:

Before this, the following requirements must be met:

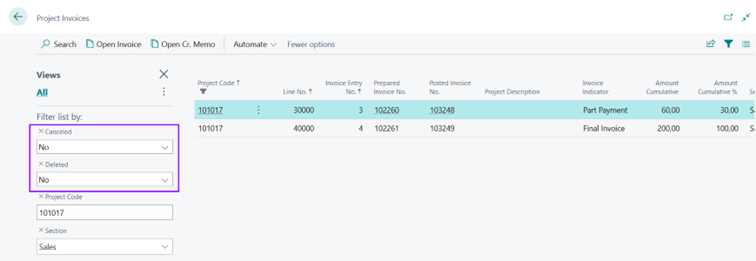

There is a detailed overview for the invoices that were created from the order. There, all unposted and posted documents are displayed and can be reviewed. This payment plan can be called up via the menu call Actions - AZM - Show pre-payments.

In this window you can find useful information such as the amounts posted, the current number of the partial invoice/payment invoice in the "Invoice no." field, whether a voucher has been deleted or posted and whether a voucher has been cancelled. No.", whether a document has been deleted or posted and whether a document has been cancelled. Canceled and deleted lines can be shown temporary bye deleting of filters.

Before creating the final invoice, the lines in the order must be delivered. This means that the quantity delivered must match the quantity field. Afterwards, the final invoice can be created via the menu call Actions - AZM - Create invoice. The invoice type Final Invoice is selected, no further selection is necessary.

When the final invoice is released, the partial invoices are deducted and displayed as a separate G/L account line in the final invoice. The G/L account is again taken from the posting matrix.

After posting the final invoice, the order is completed.

| NAVAX G/L Application G/L Application for selected G/L Accounts. More information  |