★ Featured App

NAVAX Document Text

Advanced Extended Texts (beginning/ending/line texts) for sales, purchase and service documents.

More information

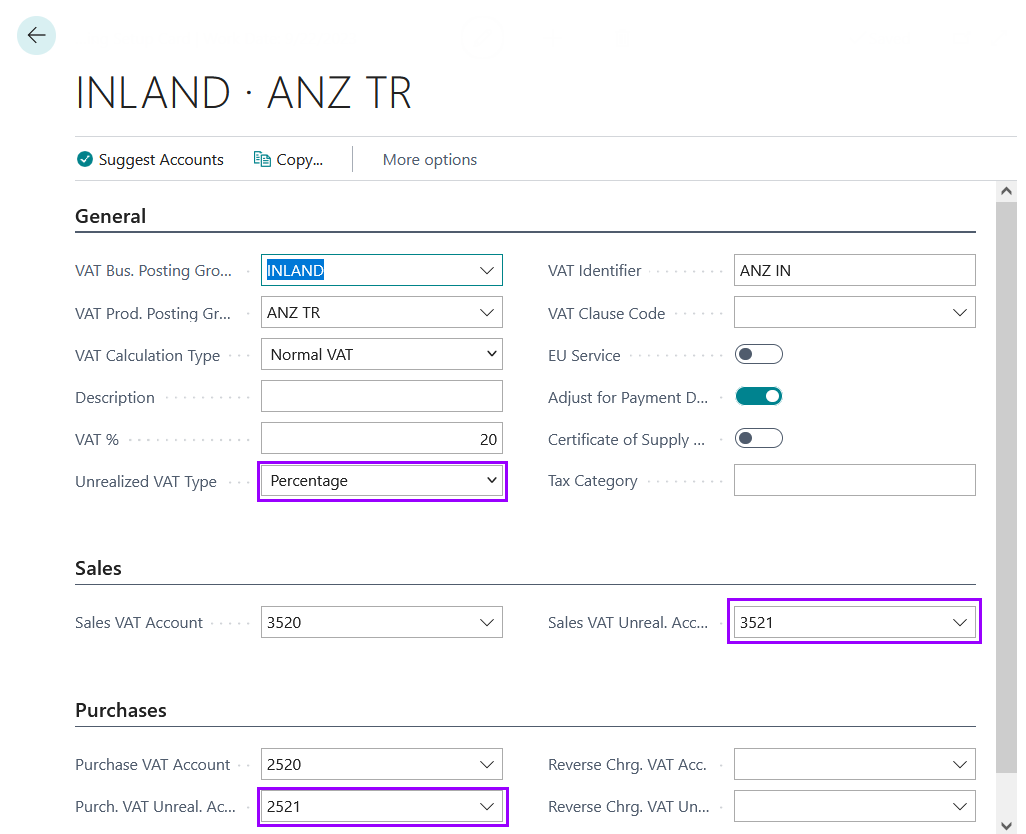

In the VAT. No programme changes were made in the VAT accounting matrix. For the unrealised VAT. posting for pre-payment and partial invoices, the following settings must be made.

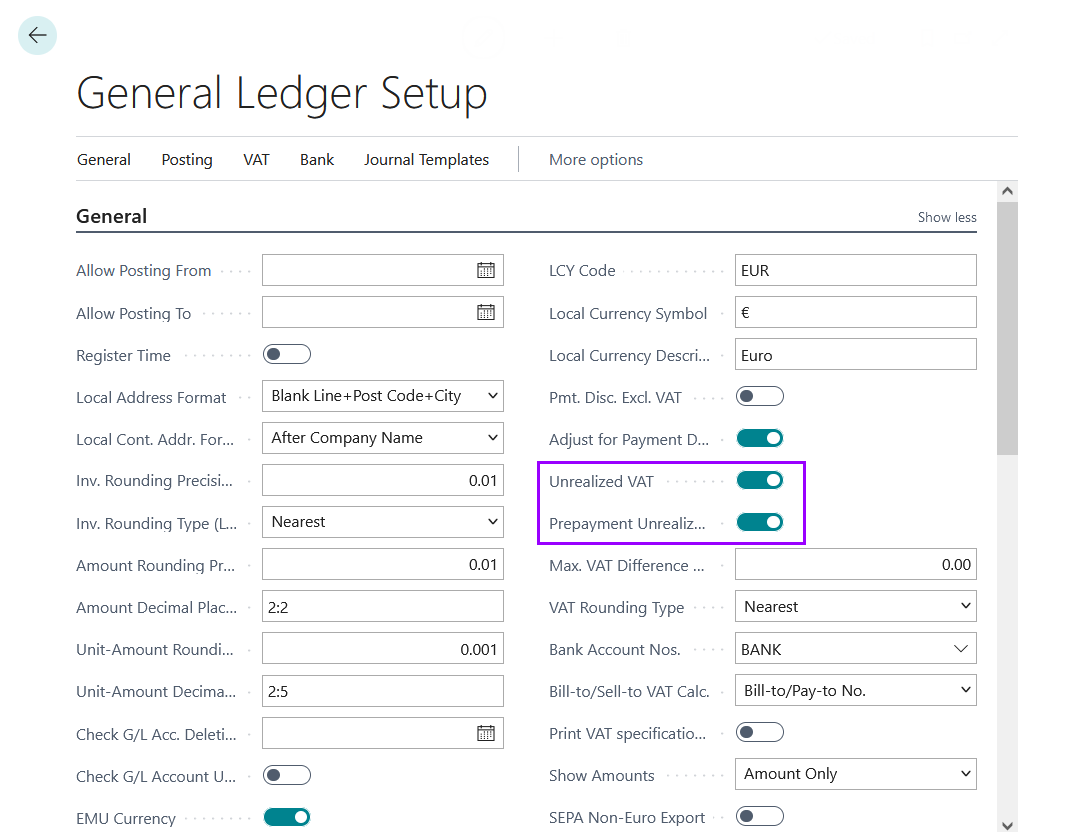

For the unrealised VAT to work, it must be activated in the financial accounting setup.

For the unrealised VAT, the value Percentage must be selected in the Unrealised VAT Type field. For the unrealised VAT type, the value Percentage must be selected in the field Unrealised VAT type (with this, 80% of the VAT is realised for a payment of 80% for a partial invoice). In the field unreal. VAT account or unreal. Input tax account, a G/L account must be entered. For purchase taxation, a G/L account must also be entered in the unreal. In the case of purchase taxation, a G/L account must also be entered in the field for unrealised purchase taxation.

| NAVAX Document Text Advanced Extended Texts (beginning/ending/line texts) for sales, purchase and service documents. More information  |